Powertech sells 60% of Centennial project to Hong Kong investment firm; inexperienced Chinese company becomes largest Powertech shareholder

Powertech agrees to sell controlling interest in dormant Colorado uranium project to recently-formed Azarga Resources; 38-year-old Australian CEO Alex Molyneux makes deal to buy out Toronto hedge fund's shares, and is likely to propose new mining and processing methods for project

Posted October 13, 2013

|

| Azarga CEO and former investment banker Alexander Molyneux |

In response to a severe cash crunch, Powertech Uranium Corp. on August 1 announced several transactions that raise much-needed working capital and transfer control of the troubled Centennial project to a Hong Kong based investment firm with no uranium mining experience. The firm, Azarga Resources Limited, becomes Powertech's largest shareholder and will advise the Canadian company's managers. The deals provide Powertech with enough cash to survive through November or perhaps December, based on the company's recent cash burn rate.

Rescued from insolvency

Powertech's bank account was down to an all-time low of $101,581 as of June 30, and the firm admits in a recent securities filing that it had an "immediate need for financing" and that there are "limited prospects for investment in the Company and its assets". Powertech "weighed the financing alternatives available to the Company" and determined that it had to sell the Centennial project. Powertech has unsuccessfully attempted to sell its "non-core assets", presumably its various uranium properties in Wyoming, according to the filing.

The deal with Azarga consists of three transactions. In the first, Azarga purchased 24,650,000 shares of Powertech stock owned by Canadian hedge fund K2 Principal Fund L.P., along with 1.5 million stock warrants, on July 22. The transaction provides no cash to Powertech. Azarga now owns approximately 17.5% of Powertech. Powertech's second largest shareholder is Societe Belge de Combustibles Nucleaires Synatom SA, a Belgian firm that owns 16.6% of the company. CEO Dick Clement's ownership stake is only 2.5%.

Run by Toronto businessman Shawn Kimel, K2 was Powertech's largest shareholder until being bought out by Azarga. There is no evidence that K2 ever sought to influence the management of Powertech. In contrast, Powertech has agreed to appoint an Azarga representative to the board of directors, and Azarga will be providing advisory services, data-sharing, and financing expertise.

In its August 21 Information Circular to shareholders, Powertech CEO Dick Clement claims that having Azarga as a "significant strategic investor" will "enhance the Company's credibility in both the uranium sector and in the financial markets". Under Canadian securities laws, Azarga and three of its executives are now considered to be "insiders" of Powertech by virtue of either their ownership stakes or their access to material information about the company and their influence over the direction of the firm.

The second transaction, a private placement agreement dated July 31, involves the issuance by Powertech of a two-year convertible debenture to Azarga in the amount of $514,350 CAD. Basically, Azarga is making an unsecured loan to Powertech, and the debt can be converted into Powertech stock under certain circumstances and at the option of either company.

Azarga appears to have negotiated a very favorable deal on the debenture. The debenture is nominally non-interest bearing, but in fact Powertech must pay disguised interest of at least 15% per year if it pays off the debt. Likewise, if Powertech chooses to convert the debt to stock, Azarga receives additional shares as if the loan had accrued interest at the same 15% annual rate. Azarga could potentially end up owning 23.5% of Powertech if the Hong Kong company exercises its stock warrants from K2 and converts the debenture after July 31, 2014.

The private placement agreement gives Azarga the right to name a director to Powertech's board of directors and to the board's audit committee. Azarga has nominated Matthew O'Kane, an Australian accountant who has spent most of his career working for automobile manufacturers Volvo Car Corporation and Ford Motor Company. The agreement also calls for Azarga to advise Powertech on corporate finance, shareholder communications, business development, investor relations, and promotions.

Centennial: Powertech's exit strategy

In the third and most dramatic transaction, Azarga purchased a controlling interest in the inactive Centennial project located a few miles northeast of Fort Collins, Colorado between the small towns of Wellington and Nunn. Powertech sold 60% of the project to Azarga for $1.5 million, thus valuing the entire project at only $2.5 million.

Powertech purchased the uranium mineral rights for the proposed project from Anadarko Land Corp. on September 27, 2006 for $4.5 million. Since then, it has accumulated total project costs of $14.8 million which have been capitalized on Powertech's balance sheet. Since the valuation implied by the Azarga deal is only 17% of the carrying cost, Powertech is finally acknowledging that it will have to take an impairment loss and write down the project on its books to reflect its diminished value.

The project, as defined in a July 31, 2013 "Letter Agreement" between Powertech and Azarga, consists of various assets. The only significant tangible assets are nine parcels of land totaling 637 acres. Powertech paid $1.8 million for the land in 2007, for an average price of roughly $2,800 per acre. Assuming the land is currently worth the same amount, the rest of the project assets would be valued at a mere $700,000. These other assets include 7,100 acres of mineral rights, almost 3,000 acres of leased surface rights, state exploration permits, and the entire work product developed over the last seven years, including geological, geochemical, and engineering reports, charts, maps, work programs, budgets, pre-feasibility studies and reports, valuations, mineral reserve estimates, and environmental and scientific datasets.

According to the letter agreement, Azarga paid Powertech $250,000 on July 31 and $750,000 on August 31. The balance of $500,000 will be paid over the next two years. Upon payment of the full purchase price, the deal calls for the formation of a joint venture between Azarga and Powertech, with Azarga being the operator. Powertech's August 1 news release states that "Azarga has no current plans to develop the Property and intends to focus on reviewing the Property for exploration and development potential."

|

| Centennial uranium project, Weld County, Colorado |

The letter agreement gives Powertech an option to sell its remaining interest in the project to Azarga for $250,000 after December 31, 2016. It gives Azarga an option to purchase Powertech's remaining interest for $7 million after the same date. If Powertech is sold, or some other event occurs which results in a change of control, Azarga can buy the rest of the Centennial project for $1 million.

It is no surprise that Powertech has been looking for an exit strategy from the unsuccessful Centennial project. For the last two and a half years Powertech has been winding down its permitting efforts as its cash dwindled and project opponents repeatedly stymied the company's progress, citing risks to the area's groundwater.

Perhaps the biggest obstacle faced by Powertech was House Bill 08-1161, state legislation developed by northern Colorado residents and landowners that requires, among other things, that in-situ leach uranium mine operators restore groundwater affected by mining to at least pre-mining water quality or to state standards. The legislation gained overwhelming bipartisan support in the legislature and was signed by Colorado Governor Bill Ritter on May 20, 2008.

When Colorado mining regulators conducted a rulemaking process to effectuate the new law, Powertech fought to weaken the rules. After the final rules were adopted in August 2010, the Canadian company sued the State of Colorado to overturn many of the rules. After a half-hearted two-year legal battle by Powertech's attorneys, the case was thrown out of court on July 13, 2012.

Earlier this year, Powertech VP of Exploration Jim Bonner told Fort Collins newspaper reporter Bobby Magill that the Centennial project was still active. The claim was less than credible, given the mountain of evidence pointing to the project's demise, including the cessation of permitting efforts, abandonment of land options, sales of key land parcels, closing of the project office, and the failed lawsuit against the state.

Bonner's claim is only the latest clumsy attempt by Powertech officials to defend the ill-fated project. At a 2009 debate on the project in a packed community hall in the small town of Nunn, former Powertech Chairman Wallace Mays launched a forceful tirade against project opponents. Proclaiming that "we will not be blackmailed" and banging his fist on the table, Mays was defiant: "I've been doing this for forty years. This is my company. This is my technology. I'm the largest single shareholder in this company. I'm here to stay..."

Mays resigned as chief operating officer and Chairman of Powertech in May 2011, and resigned as a director in May 2012. He still owns 1.3% of Powertech, but he has agreed to sell his stake to Powertech executives Tom Doyle and Greg Burnett at their option.

Powertech is undoubtedly pleased to find someone to take over the Centennial project and thereby avoid a public admission that the project has been a failure. Whether Azarga has any intention of actually restarting the permitting process for an in-situ leaching operation, however, is unclear.

Alexander Molyneux, SouthGobi, and the Friedland connection

The public face and chief executive officer of Azarga Resources Limited is 38-year-old Australian-born Alexander Molyneux. Holding a bachelors degree in economics from Australia's Monash University, Molyneux has spent most of his career as an investment banker to mining and other companies in Asia, working for UBS, Citigroup, and Deutsche Bank.

|

Robert Friedland and the Summitville disaster In 1986, Summitville Consolidated Mining Company Inc. (SCMCI) began open pit mining and heap leaching for gold and silver at the historic Summitville mining site located 25 miles southwest of Del Norte in the San Juan Mountains. The 1,231-acre mine site is located at an average elevation of 11,500 feet, and surface water from the site drains into the Alamosa River. The company applied a sodium cyanide solution to crushed ore on the heap leach pad to extract gold and silver. SCMCI was an indirect subsidiary of Robert Friedland's company Galactic Resources Ltd., based in British Columbia, Canada. As chairman and CEO of Galactic and a director of SCMCI, Friedland put the Summitville mine deal together and oversaw the development of the mine. According to a post-mortem report on the disaster by the Colorado Department of Natural Resources, there was "an atmosphere of pressure" created by company officials, local government officials, and others to accelerate review and approval of the permit application. SCMCI's permit application was initially rejected by Colorado mining regulators, but after Friedland complained to state legislators, the permit was approved. The state report notes that "the permit was approved before the company's plan of reclamation was fully developed", and that SCMCI's contractor constructed the heap leach pad under adverse winter conditions despite warnings against this by the company's design consultant. During construction in spring 1986, the HDPE plastic pad liners were shifted and torn by avalanches. A dispute arose between SCMCI and a contractor when the contrator wanted to fix the liners but was blocked by SCMCI. The contractor sued SCMCI to repair the liners but lost in court. The site was inspected by Colorado mining regulators and the pad liners were certified, except for areas of the liners covered by snow. On June 10, 1986, five days after sodium cyanide leach solution was first applied, a leak was detected beneath the primary pad liner. Eight days later, state inspectors detected cyanide beneath the secondary liner. Rather than shutting down the project to evaluate the problems and repair the liner leaks, regulators allowed leaching to continue, based on faulty engineering calculations submitted by SCMCI. During 1987, nine cyanide leaks and spills occurred as a result of pump or pipeline failures, for which SCMCI was issued Notices of Violations by Colorado mining and public health regulators. Because of large amounts of snow melt and acid mine drainage flowing into the heap leach pad, and an inadequate water treatment system, SCMCI sought and received approval from Colorado regulators to land apply contaminated water on site. Regulators discovered in 1990, however, that contaminated fluids were being released into Wightman Fork, which flows into the Alamosa River. It was later reported that all fish and most aquatic life was killed along a 17-mile stretch of the river. Multiple permit violations were documented, and the State of Colorado issued a cease and desist order to SCMCI for discharging cadmium, aluminum, copper, zinc, and cyanide without a permit. As problems mounted, Friedland resigned from his positions at Galactic in 1990. In March 1992, SCMCI stopped applying cyanide solution to the leach pad. SCMCI, facing pressure by Colorado regulators to post larger bonds to cover stabilization and reclamation of the site, abandoned the Summitville mine on December 15, 1992 and filed for bankruptcy. SCMCI was under a court injunction ordering the company not to abandon the site. Galactic followed suit by declaring bankruptcy in 1993, and the company was delisted from the Toronto Stock Exchange in 1994. Because the the Summitville mine was "seriously underbonded", Colorado regulators did not have the resources to intervene and stop the acid drainage and heavy metal contamination being released from the site. At the request of the State of Colorado, the U.S. Environmental Protection Agency's Region 8 sent an emergency response team to take control of the site on December 16, 1992. The EPA was able to avert an impending catastrophic release of cyanide and metal-laden solutions from the leach pit by restoring and maintaining necessary water circulation and treatment systems. Without intervention, spring runoff would have overflowed the impoundment and released contaminants into the Alamosa River. Steps were also taken to plug horizontal tunnels to underground mine workings that were a major source of contaminated water discharges. As a result of the Summitville disaster, the Colorado Mined Land Reclamation Board organized a committee of representatives from the mining industry and environmental groups, and state legislators, to develop amendments to the state's Mined Land Reclamation Act. On April 26, 1993, The Colorado Legislature unanimously passed Senate Bill 247 that made significant changes to Colorado mining law. Changes included a requirement that mInes with a high potential for contamination must prepare an Environmental Protection Plan, state authority to amend existing operating permits, extended permit application reviews, strengthened bonding authority, increased fees, and authority for emergency response and intervention by the state. Summitville was placed on the National Priorities List of Superfund sites on May 31, 1994. The total cost of cleanup, which is ongoing, has been estimated to be over $150 million. The State of Colorado had only required SCMCI to post a cash bond of $2.3 million. According to the EPA and Colorado regulators, the Alamosa River for several miles below the site cannot support aquatic life due to contamination from SCMCI's activities at the Summitville site, as well as from historic natural and mining-related contamination in the Alamosa River basin. Under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (CERCLA), the EPA is authorized to identify parties responsible for contamination of sites and compel the parties to clean them up. If the EPA could not find responsible parties, the agency previously used a special trust fund funded by a tax on the petroleum and chemical industries. This tax was repealed in 1995; since then, U.S. taxpayers have paid for the cleanup. In 1996, the bankrupt SCMCI pleaded guilty to 40 felony counts, the majority related to the unauthorized discharge of cyanide, arsenic, cadmium, copper, lead, mercury, and other heavy metals into the Alamosa River. The company was fined $20 million, the maximum. In 2000, the U.S. Department of Justice and the State of Colorado reached a $27.75 million settlement with Friedland to pay for damages and site remediation, ending over four years of lawsuits against Friedland by the EPA and State of Colorado. In a news release announcing the settlement, Friedland denied any personal responsibility for the Summitville disaster and said a Canadian court had found that other SCMCI executives were in charge of the mine and had made the key decisions regarding the damaged leach pad liner and the abandonment of the mine. The settlement with Friedland called for him to pay $27.75 million over 10 years. During 2001, Friedland made a lump-sum payment of $20.28 million to fully satisfy his obligation under the settlement. Also as part of the settlement, the U.S. government paid Friedland $1.25 million for his legal fees after unsuccessfully attempting to seize his financial assets. According to Friedland, by 2007 he had recovered $24.8 million from lawsuits against contractors involved with the design and construction of the Summitville Mine. |

In 2009, Molyneux was itching to leave investment banking and move to the "client side". In April of that year, Molyneux became CEO of SouthGobi Energy Resources Ltd., a Canadian company that owns coal mining properties in Mongolia. SouthGobi was controlled by Canadian firm Ivanhoe Mines, founded by Robert Friedland, an international mining mogul and financier. An Australian news story described Molyneux as an "investment banking wunderkind" who was hand-picked by Friedland to run SouthGobi.

|

| Robert "Toxic Bob" Friedland |

The 63-year-old Friedland resides in Singapore and has dual citizenship in the United States and Canada. According to Forbes, Friedland has a net worth of $1.15 billion as of September 2013, and was listed number 831 on Forbes' 2013 Richest People on the Planet list published in March.

Friedland, referred to by some as "Toxic Bob", is perhaps best known for his role in the Summitville mine disaster in southwestern Colorado (see sidebar).

Molyneux is a longtime business associate of Friedland, according to a news report. In a July 31 interview with Bloomberg, Molyneux says his relationship with Friedland was how he was able to move into the mining industry from investment banking. Molyneux was also appointed to the board of directors of Friedland's oil and gas company, Ivanhoe Energy Inc., in 2010.

Molyneux's move to SouthGobi was part of an Australian push into the booming Mongolian mining industry. Fellow Australians Curtis Church and Matthew O'Kane were also hired by SouthGobi. Church and O'Kane would later help Molyneux start Azarga Resources. Unfortunately for SouthGobi, Mongolian animosity toward China would disrupt SouthGobi's business and eventually cost Molyneux, Church, and O'Kane their jobs.

In March 2012, Friedland cut a deal to sell Ivanhoe Mines' stake in SouthGobi to Aluminum Corp. of China (Chalco). The Mongolian government, responding to public hostility toward China, opposed the Chalco takeover. In April the government suspended SouthGobi's mining licenses, and later revised foreign investment laws to require special government review of foreign mining deals.

Chalco responded by postponing the takeover deal. A frustrated Molyneux reacted by publicly criticizing the Mongolian government. In the meantime, British-Australian mining corporation Rio Tinto completed a "creeping takeover" of Ivanhoe Mines in July, changed Ivanhoe's name to Turquoise Hill Resources, and forced out Robert Friedland. Rio Tinto's intent was to gain control of the massive Oyu Tolgoi copper-gold mine from Friedland. As such, Rio Tinto was anxious to avoid antagonizing Mongolian officials at a time when resource nationalism was on the rise.

The day after he resigned and Rio Tinto took over, Friedland had a paper gain of $182 million on his 14 percent stake in Ivanhoe after the stock jumped 15 percent.

Ten days after Chalco dropped its bid for SouthGobi in September 2012, Alex Molyneux was fired. Rio Tinto replaced him with a veteran executive who actually had mining experience. Some observers think Molyneux's sacking was largely an attempt by Rio Tinto to improve its strained relationship with the Mongolian government and distance SouthGobi from the Friedland era.

Molyneux's performance as SouthGobi's CEO may have factored into his termination. In Molyneux's last two full years at the helm of SouthGobi, the company had operating losses of $38 million and $47 million. In 2011, SouthGobi's cash flow was negative $368 million. That year, Molyneux received total compensation of $2.9 million.

In October 2012, SouthGobi Chief Operating Officer and fellow Australian Curtis Church was fired. A month later, Chief Financial Officer Matthew O'Kane resigned.

Azarga Resources: How to profit from the uranium renaissance

Azarga Resources Limited is a private investment holding company incorporated in the British Virgin Islands on May 12, 2012. It was later incorporated in Hong Kong on February 26, 2013 by Joseph Havlin, a certified public accountant who lives in China and is currently a director of Azarga.

Following the SouthGobi debacle, Molyneux, Church, and O'Kane moved to Azarga and began to raise money from Asian investors. As of July 17, 2013, Azarga was owned by the following individuals and entities:

| Alexander Molyneux | 29.41% |

| Curtis Church | 29.41% |

| Pacific Advisors Pte Ltd | 19.61% |

| Powerlite Ventures Limited/Blumont Group Ltd | 17.65% |

| (Unknown) | 3.92% |

Control of Azarga is firmly in the hands of Molyneux and his fellow Australian Curtis Church. Unlike Molyneux, Church has actual mining experience, working for several years for various mining companies including BHP Billiton, one of the world's largest mining firms. It is not clear if Church has ever worked at a uranium mine; his LinkedIn profile only mentions work experience at coal and gold mining operations.

Azarga's third largest shareholder is Pacific Advisers Pte Ltd., a Singapore-based boutique mergers and acquisitions and financial advisory firm, as described by one financial journalist. The firm is run by former Morgan Stanley investment banker Jay McCarthy and owns almost 20% of Azarga.

Roughly eighteen percent of Azarga is owned by the private company Powerlite Ventures Limited, an investment holding company based in the British Virgin Islands. Powerlite appears to be run by a group of Singaporean and Malaysian attorneys and investors, including Malaysian Lee Chai Huat. Powerlite's only significant holding is its 17.65% stake in Azarga, according to a recent news release.

In July 2013, Powerlite was taken over by the Singapore firm Blumont Group Ltd. Until recently, Blumont was run by businessmen James Hong Gee Ho and Neo Kim Hock. The company was previously an internet services provider, and its main operating subsidiary runs a commercial irradiation sterilization facility in Jakarta, Indonesia. Blumont has recently been investing in mineral resource assets, and is listed on the Singapore stock exchange.

Blumont's largest shareholders are Malaysian Neo Kim Hock and Malaysian firm Clear Water Developments Sdn Bhd.

Over the last year, Blumont shares had increased over 4,000%, from $0.06 SGD to $2.45 SGD, prompting a detailed inquiry from the Singapore Exchange regarding the reasons for the steep price increase. In early October, the Securities Investors Association called the stock activity "unusual" and called for an immediate investigation by the authorities.

Beginning on October 2, the Blumont share price collapsed over four trading days, falling from $2.44 SGD to $0.13 SGD on October 7, a drop of 95%. As the Singapore Exchange placed trading restrictions on the shares, Alex Molyneux stepped in and agreed to purchase 135 million shares of Blumont for between $0.20 SGD and $0.40 SGD per share. Molyneux will buy 95 million shares from Neo Kim Hock, and 40 million from an unnamed investor. After completion of the purchases in early November, Molyneux will own 5.2% of Blumont.

As part of the deal, Molyneux will become the chairman of Blumont, replacing Neo Kim Hock. Since Blumont holds a 17.65% indirect stake in Azarga and directly owns 11.48% of Celsius Coal Ltd. (Molyneux is executive chairman of the Australian company), Molyneux's new position at Blumont raises questions regarding conflicts of interest and whether he can act independently as chairman of each of the three companies.

--------------------------------------------------------------------

In the last several months, Azarga has moved aggressively to acquire interests in several uranium properties. In a July 2013 interview by former hedge fund analyst Peter Epstein, Molyneux touts the beaten-down uranium mining industry and describes his plan to invest in four to five junior uranium companies where Azarga can "add significant value". Molyneux asserts that by 2016 the world will see record levels of nuclear power generation and a uranium spot price of $80 per pound (the current spot price is $35.25 and some analysts don't expect the price to rise significantly for the next few years).

In a January 2013 news release, Molyneux announced that "we are very bullish about the uranium renaissance to come and believe it will start as early as 2013". Based on the depressed spot price for uranium, the "renaissance" hasn't yet arrived.

In March 2013, Azarga purchased 19.67% of Australian firm Black Range Minerals Limited for $2.3 million. Black Range owns the Hansen/Taylor Ranch uranium exploration project west of Cañon City, Colorado. While Black Range claims it is "seeking to secure permitting for the Project by 2016", no permit applications for mining have been submitted, and no feasibility studies have been released. The deal calls for Azarga to provide ongoing marketing and financial support, and gives Azarga the right to a seat on the Black Range board of directors. Azarga has not yet nominated a director. The next largest shareholder of Black Range owns only 2.75% of the company.

Azarga announced in August that it had acquired additional shares of Australian firm Anatolia Energy Limited, bringing its ownership of Anatolia to 10.1%. Anatolia owns the Temrezli, Sefaatli, and West Sorgun uranium exploration projects in Turkey. Anatolia's most recent Quarterly Activities Report indicates that the company has not obtained mining permits for any of its properties.

On October 8, it was reported that the Turkish government had granted "operation licenses" for the Temrezli project. The significance of this is unclear since the company reportedly said that a decision to develop the project will not be made until a pre-feasibility study is prepared, which will occur after a drilling program and metallurgical and hydrological studies are completed. An "operation permit" is still required before construction can begin, and this permit cannot be obtained until an environmental impact assessment is submitted and approved.

Anatolia is run by Turkish geologist Hikmet Akin and American nuclear industry executive James Graham. Graham has extensive experience in the nuclear fuel industry, including two years as CEO of Cotter Corporation. Cotter is the owner of two of the most contaminated and potentially dangerous uranium sites in Colorado: the Schwarzwalder mine in Jefferson County and the Cotter uranium mill, a Superfund site in Cañon City. Both sites are closed and undergoing decommissioning and reclamation.

The Kyrgyzstan story

|

| Aerial view of the town of Mailuu Suu in the Kyrgyz Republic. A significant Soviet uranium mining area from 1946 to 1968, the USSR left numerous uranium tailings pits on the hillsides above the town that are subject to landslides. |

According to Powertech's August 1 news release, Azarga owns an 80% operating interest in the Kyzyl-Ompul uranium project, described as the "largest known soviet-era resource in the Kyrgyz Republic". The Kyrgyz Republic, also referred to as Kyrgyzstan, is a former Soviet republic that is now a member of the Commonwealth of Independent States. Kyrgyzstan provided much of the uranium for the USSR's nuclear weapons program during the Cold War.

Following the breakup of the Soviet Union in 1991, Kyrgyzstan was left with dozens of abandoned tailings pits and hazardous waste dumps that threaten rural communities due to landslides, floods, mudflows, and earthquakes. A 2000 United Nations report notes that "Intensive production methods and the almost complete neglect of environmental protection measures during the past decades have led to the accumulation of large amounts of mining waste throughout the country. In most cases, the conditions in which those wastes are stored violate even basic environmental protection rules, and they represent a direct threat to the population and the environment."

According to a Kyrgyz government report, the proximity of most of the tailings and waste dumps to major river basins creates "a high risk of an ecological catastrophe that could potentially affect territories in Kyrgyzstan, Kazakhstan, Tajikistan and Uzbekistan with a total population of 5 million people".

The exploration license for the Kyzyl-Ompul site was acquired by Urasia Energy Ltd. in early 2006. It was one of seven Kyrgyzstan exploration licenses acquired by the Canadian company. A 2008 Powertech news release notes that former Powertech Chairman and Chief Operating Officer Wallace Mays was the Operations Manager for Central Asia for Urasia Energy Ltd. from 2005 through early 2008, and he managed Urasia's uranium exploration activities in the Kyrgyz Republic.

In April 2007, Urasia Energy was acquired by Uranium One Inc., which incurred exploration costs for the Krygyzstan properties before it removed any reference to the properties in its quarterly and annual securities filings in 2009. There does not appear to be any publicly-available information on how the Kyzyl-Ompul site eventually came to be under the control of Azarga.

It is not clear if Powertech's assertion that Kyzyl-Ompul is the "largest known soviet-era resource in the Kyrgyz Republic" originated with Azarga or with Powertech officials. But after an extensive search of internet sources, including the U.S. Geological Survey, International Atomic Energy Agency, World Nuclear Association, Government of the Kyrgyz Republic, and various Canadian securities filings, there appears to be no available evidence supporting a claim that Kyzyl-Ompul was even one of the major uranium mining sites during the Soviet era, much less the largest known resource. Likewise, it appears that Urasia Energy and Uranium One did not consider Kyzyl-Ompul to be very promising since neither company reported any significant ongoing exploration expenditures related to the site.

Adding value through perception management

So what is Molyneux's plan for the Centennial project, and for his other uranium-related investments? Given his investment banking background and lack of uranium mining experience, it seems unlikely that Molyneux intends to restart the permitting process for the proposed northern Colorado project. Clues to his strategy may be found in his close association with Robert Friedland, his stated desire to "add significant value" to his investments, and in his stake in Black Range Minerals.

Friedland's talent lies in developing and promoting high-risk mining projects that he later sells at a profit to larger mining firms. Molyneux may be hoping to follow the Friedland model with the Centennial project and Black Range Minerals (and perhaps with his Kyrgyzstan and Turkey investments).

Step one is buying low. It is unknown what Azarga paid for its Anatolia stake or for its Kyrgyzstan prospects, but Molyneux has stated publicly that "Black Range was very cheap". Black Range is listed on the Australian Securities Exchange and is the quintessential penny stock, with a 52-week trading range of $0.01 to $0.02 AUD. Its market capitalization of roughly $17 million USD is only slightly better than Powertech's market cap of $11 million USD. According to its latest annual report, Black Range has only three employees. As of June 30, 2013 the Australian company's cash position was only $469,323 AUD.

Azarga acquired its 17.5% stake in Powertech at only $0.07 CAD per share, close to the 52-week low of $0.06 CAD. And Azarga picked up its interest in the Centennial project for a song; the price it paid was only 17% of what Powertech CEO Dick Clement claimed as its value on Powertech's most recent balance sheet.

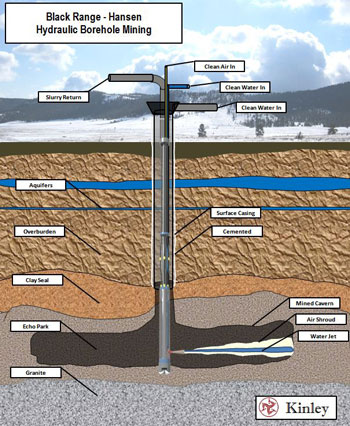

The "significant value" Molyneux intends to add is likely his promotion of two unconventional mining technologies for the projects: borehole mining and ablation. Black Range is pushing both techniques for the proposed Hansen/Taylor Ranch project. Molyneux may believe that shifting the narrative of the Centennial project from the controversial in-situ leaching process to the technologies of borehole mining and ablation can rehabilitate the project in the eyes of investors, industry executives, regulators, and local residents and landowners, thus increasing the value of his investment. Moreover, Molyneux may believe that borehole mining and ablation can avoid the permitting challenges Powertech faced with in-situ leaching.

The future of uranium mining? Borehole mining and ablation

Borehole mining is an underground mining system that uses a high-pressure water jet at the bottom of a drilled well to excavate and fragment the uranium-containing rock. The resulting slurry is then pumped to the surface for further processing. There appear to be no reports of uranium mines using borehole mining, so the process is still experimental and unproven on a commercial scale. The technique was tested on uranium deposits by the U.S. Bureau of Mines in the 1970s. Currently, the closest system is the "jet boring" method planned for Cameco Corp.'s Cigar Lake uranium project in Canada. The process uses high-pressure water jets operated from tunnels below the orebodies, and has undergone testing but has not yet proven to be commercially viable.

Ablation is the second technology promoted by Black Range and Azarga. According to Black Range's website, an ablation machine takes the slurry from borehole mining and ejects it "from two opposing injection nozzles to create a high impact zone. This high-energy impact separates the mineralized patina (coating) of uranium from the underlying grain". The slurry has to be run through the nozzles an average of 15 times. Screening and gravity separation processes separate 90% or more of the uranium from the sandstone grains and clays. According to Black Range, only 10% of the mined material is left to transport to a uranium mill for final processing into yellowcake.

The ablation process was developed by a team of Casper, Wyoming inventors led by James Coates, and a patent application for the process was published on March 21, 2013. The pending patent is owned by Ablation Technologies, LLC, a Casper business formed in 2010. James Coates is president of Ablation Technologies.

|

| Ablation skid - Ablation Technologies, LLC, Casper, Wyoming |

In July 2012 Black Range entered into an agreement with Ablation Technologies forming a 50/50 joint venture to develop and commercialize the ablation technology. The joint venture entity is Mineral Ablation LLC, a Wyoming company formed by James Coates. Prior to forming the joint venture, Black Range acquired certain rights to the ablation technology from attorney, cattle rancher, and uranium company executive George Glasier. Glasier is the founder and former CEO of Energy Fuels Inc., the owner of the proposed Piñon Ridge uranium mill in southwestern Colorado. Glasier obtained the rights through a short-lived joint venture in 2012 between Ablation Technologies and American Strategic Minerals Corporation, a firm he controlled. Glasier is now a consultant to Black Range and a major shareholder.

Ablation is hyped by its supporters as "revolutionary", a "game-changer", and possibly "the most important development in uranium recovery in the last fifty years". It is touted as a less expensive method of concentrating uranium ore because the process can be done at the mining site, thereby reducing hauling costs to a mill for final processing. In addition, fewer chemicals are needed to produce yellowcake.

Currently, the most common uranium mining method in the United States is in-situ leaching, and is the process Powertech proposed for the Centennial project as well as the Dewey-Burdock uranium project in South Dakota. ISL operations involve the underground injection of various substances and chemicals including gaseous or liquid oxygen, carbon dioxide, and sodium carbonate-bicarbonate to dissolve and extract the uranium. During the aquifer restoration phase, barium chloride, hydrogen sulfide, sodium sulfide, and other substances may be injected into the aquifer.

In recent years the uranium industry has adopted the term "in-situ recovery" in an attempt to replace the more descriptive "in-situ leaching", and thus promote the method as an environmentally-benign alternative to underground or open-pit mining.

Unlike in-situ leaching, which has an intentional and profound impact on the groundwater chemistry, borehole mining and ablation are primarily mechanical processes. That said, both borehole mining and ablation can unintentionally mobilize uranium and other heavy metals due to the presence of dissolved oxygen in the highly pressurized process water. As pressure increases, water can hold more dissolved oxygen. The level of dissolved oxygen in a water source can also be affected by several factors including temperature, wind, turbulence, altitude, and the presence in the water of organisms, dissolved or suspended solids, chemical pollution, and organic material.

In-situ leaching of uranium depends on having sufficient hydraulic head above the mining zone to increase the water pressure. Oxygen is added to the injected lixiviant to mobilize the uranium, and the higher water pressure is needed to maintain the elevated levels of dissolved oxygen in the aquifer zone being mined. While oxygen is not intentionally added to the process water for borehole mining, naturally occurring dissolved oxygen in the water could unintentionally mobilize uranium and other heavy metals that could potentially migrate beyond the mine area if the process is being conducted in a saturated formation.

|

| Simplified drawing of borehole mining process. Note the separation of the mining zone from the aquifers. Most of the Centennial project's uranium deposits are located within an aquifer. |

With respect to ablation and the issue of dissolved uranium, the patent application includes descriptions of several test runs that appear to contain contradictory results. However, Coates admits in the application that certain tests showed that water from the ablation process contained dissolved uranium and radium, which was then "recovered from the water via ion exchange and reverse osmosis. The use of ion exchange to recover dissolved uranium is the same process used by in-situ leaching facilities.

The patent application notes that "when sandstone-hosted uranium ores are ablated with untreated water", one-tenth to one-third or more of the total uranium in the ore may be dissolved into the ablation fluid, depending on the ore deposit and water used. The host formations within the Centennial project are sandstone.

If borehole mining is conducted in an aquifer, the potential escape of fluid containing uranium, radium, arsenic, and other heavy metals is concerning since the process, unlike in-situ leaching, is not designed to prevent excursions from the mining zone. An ISL uranium mine balances pumping rates of injection and production wells to create a pressure gradient that, in theory, prevents excursions of mining fluid outside of the mine permit area. Put another way, more fluid is pumped out than is injected. In addition, there is a ring of monitor wells surrounding the injection and production wells designed to detect excursions. These measures intended to protect the surrounding aquifer work most of the time, but excursions, some lasting for years, are not uncommon at ISL mines.

Presumably, Black Range and Azarga believe no monitoring wells are necessary since borehole mining uses only water and no added reagents such as oxygen. But the published patent application for ablation reveals that water with naturally occurring dissolved oxygen has the potential to mobilize uranium and radium, a result that would logically extend to borehole mining. Since Black Range proposes to drill approximately 2,600 individual boreholes at the Hansen project, the potential to contaminate area aquifers is a significant concern that needs to be addressed as part of any permitting process.

To permit, or not to permit

Since borehole mining and ablation have never been used on a commercial scale to mine and process uranium, the two methods are not specifically addressed by federal and Colorado radioactive materials regulations. Not surprisingly, the proponents of the two technologies appear to be taking the position that both are simply mining methods and thus not subject to federal and state regulations that govern post-mining processing of uranium ore. But some are questioning this, including various mining watchdog organizations, and they appear to be gaining traction with regulators.

In July 2012, Tallahassee Area Community, Inc. sent a letter to the U.S. Nuclear Regulatory Commission noting the experimental nature of borehole mining and ablation. According to TAC, since neither process has been used commercially on uranium deposits, the NRC and "agreement states" (those states, including Colorado, that have been approved by the NRC to regulate certain radioactive materials) have not considered these technologies, and consequently their regulatory status is unclear. TAC urged the NRC to adopt the position that both technologies are uranium milling/processing activities that require licensing by the NRC or the State of Colorado. TAC is a grassroots organization formed to fight the Hansen/Taylor Ranch uranium project.

Eight months later, the NRC responded to TAC's letter. The NRC determined that borehole mining is a mining process, not milling, and therefore radioactive material licensing is not required. However, the NRC's take on ablation is different. According to the letter, "After review of the ablation process, it appears that the proposed surface ablation processing is an ore grinding or refining process that is subject to source material licensing under 10 CFR Part 40 (or Agreement State equivalent regulations). A source material license is required because the ablation process physically changes the ore."

And the NRC indicated that its review of ablation is just beginning: "As stated above, the ablation process would, at a minimum, be required to have a source material license. The NRC is also evaluating whether the application of this process to uranium recovery should be licensed as uranium milling." The letter notes that this is consistent with the determination by the Colorado Department of Public Health & Environment (CDPHE) that "the proposed process, if implemented as we now understand it, would result in the possession of source material and would, therefore, require a source material radioactive material license at a minimum."

In accordance with federal law, uranium or ores containing by weight 0.05% or more of uranium are defined as "source material". A facility that processes natural uranium ore by concentrating the uranium is considered a "source material facility" and must be licensed by the NRC or the appropriate agreement state.

An April 2013 report issued by TAC states that the NRC's preliminary determination that borehole mining is merely a mining technique would be challenged when a mining permit application incorporating the technology is submitted. In addition, the report notes that an official from the U.S. Environmental Protection Agency's Region 8 office in Denver told TAC that the agency will require a Class III Underground Injection Control Permit for any borehole mining wells, including wells used for testing the process. The EPA's UIC program implements provisions of the Safe Drinking Water Act that are intended to protect underground sources of drinking water.

A Class III UIC permit is the same permit required of in-situ leach uranium operations. Powertech submitted its Class III UIC permit for the proposed Dewey-Burdock uranium project in South Dakota to the EPA's Region 8 office in December 2008. Due to several issues, including the fact that the EPA has never issued a UIC permit for in-situ leach uranium mining, the agency has yet to issue a draft permit to Powertech.

Nuvemco LLC and the October Ore Pile

On July 31, Black Range announced it had earlier in the month executed an agreement with Nuvemco LLC to truck roughly 100 tons of low-grade uranium ore from Nuvemco's October Ore Pile near Gateway, Colorado to Ablation Technologies' facility in Casper, Wyoming. Black Range intended to run "large-scale" ablation tests on the ore, and if successful, plans to ablate the entire 10,000 ton October stockpile. The October ore was mined prior to 1972 on a series of mining claims staked by Climax Uranium Company in the 1950s.

Nuvemco is the trade name of Ventura Uranium, LLC, a Colorado limited liability company formed by Jacob Eisel in 2006. The company is run by Denver businessman and accountant Paul Szilagyi. Nuvemco has acquired several abandoned uranium mine sites located in the Uravan Mineral Belt in southwestern Colorado, including the October Ore Pile, Monogram, Last Chance, and Monogram-Jo Dandy.

|

| Google Earth view of the October Ore Pile, Mesa County, Colorado |

None of the uranium mines are currently producing, and it is likely the company has seen little revenue from the "extensive ablation testwork" done on samples from the October stockpile during the past few months. This hasn't stopped Szilagyi from publicly referring to Nuvemco as a "$20 million development stage mining company", a characterization that typically refers to a company's annual gross operating revenue. Nuvemco's three-page website doesn't mention a single project or mine, but notes, oddly, that "Nuvemco has many pieces of heavy equipment ready to go to work."

Nuvemco asserts that it is not required to prepare an Environmental Protection Plan for the October Ore Pile, as required under the Colorado Mined Land Reclamation Act, since it is not a mining operation. In a 2011 letter to the Colorado Division of Reclamation, Mining and Safety (DRMS), Nuvemco's consultant provided a one sentence non-specific description of measures it said the company has taken to prevent acid and toxic drainage from the site.

In a July 19, 2013 letter from Nuvemco to the DRMS notifying the agency that the company planned to end the site's "temporary cessation" status and truck the ore to Wyoming, Szilagyi calls ablation "a continuation of mining". The implication is that source material licensing is not required. (Since Wyoming is not an agreement state, the NRC issues source material licenses for Wyoming uranium facilities.) By this time, uranium mining watchdogs in Colorado had already heard from both the NRC and the CDPHE that source material licensing would in fact be required based on the agencies' current understanding of the process.

In a joint letter to the NRC on August 6, 2013, several regional organizations asked if the agency had received an application for a source material license "from any of the parties involved in the processing of ore from the Nuvemco site in Mesa County, Colorado", or whether any license had been issued "for an ablation or other ore processing facility in Wyoming to Ablation Technologies, Black Range, or another company".

The organizations indicated that they share an interest in how ablation will be regulated, and noted that "it is our understanding that NRC has determined that ablation is source material processing, which requires the appropriate source material processing license and is subject to a public review and approval process". The letter is signed by representatives of Colorado organizations Information Network for Responsible Mining (INFORM) and Tallahassee Area Community, Inc. (TAC), Wyoming-based Powder River Basin Resource Council, and Utah-based Uranium Watch.

In response to the joint request, on August 13, 2013 NRC Project Manager Doug Mandeville emailed Ablation Technologies requesting that the Casper company contact the NRC to discuss licensing, stating that "it appears that the ablation process would require a source material license". Two weeks later, the NRC wrote the four regional uranium mining organizations to say that no license applications have been received and no licenses have been issued. The letter mentions that "we have contacted the company and continue to review the situation to identify NRC's appropriate course of action".

According to someone with knowledge of the matter, NRC staffers have not yet been in direct contact with representatives from Ablation Technologies. It is unclear if the Wyoming company has conducted ablation processing of uranium ore that requires source material licensing, and if it is potentially in violation of NRC regulations.

Fix and flip (It's easier than mining!)

Alexander Molyneux appears to have little or no uranium permitting or mining experience, so it seems unlikely that he would be interested in doing the highly technical, detailed, and time-consuming work of permitting, developing, and operating a uranium mine. The Molyneux/Azarga strategy may simply be to buy stakes in struggling uranium exploration firms at rock bottom prices, provide some desperately-needed cash, promote the use of the "game-changing" technologies of borehole mining and ablation, and then orchestrate bidding wars by larger established mining firms for the individual projects, the exploration firms, or perhaps for Azarga itself.

|

| Chart showing Alexander Molyneux's mining-related holdings and corporate directorships as of mid-October 2013, compiled from public sources. (Click on chart for larger PDF version.) |

In a July 12, 2013 interview with investment analyst Peter Epstein, Molyneux spoke at length about ablation. Molyneux asserted that ablation "is very valuable in a low uranium price environment", even though the process has never been deployed on a commercial scale. While acknowledging that "many issues can pop up from nowhere to hamper these types of projects", Molyneux insisted that "Ablation is doing just fine!"

Molyneux reveals in the interview that he and Epstein visited Ablation Technologies' facility in Casper in March of this year and that he was "blown away" by the Wyoming firm's prototype ablation machine. He "can't wait to see ablated concentrate move to a uranium mill" in the next six months, apparently unaware of the brewing controversy over federal and state source/radioactive material licensing.

The Azarga CEO said that he has come to see ablation as "a game-changer in terms of what it can do for costs and capital of certain uranium deposits. It has huge value and I'm much more certain its value will be recognized by producers going forward. I'm aware of some powerful groups showing interest in ablation." At the time Molyneux made this ringing endorsement, the largest ablation machine in existence was a 750-1,500 pound per hour prototype that would probably fit in the back of a Ford F150.

Asked by Epstein if Azarga has any plans to use ablation beyond Black Range's Hansen/Taylor Ranch project, Molyneux answered in the affirmative. He said uranium ore from Krygyzstan has been sent to Casper for testing, and noted that "ablation will work in sandstone-hosted uranium deposits". Both of Powertech's projects, Centennial in Colorado and Dewey-Burdock in South Dakota, are sandstone-hosted uranium deposits.

Molyneux also said Azarga is "keen" on helping market ablation to China National Nuclear, which operates the largest uranium mine in China. China is currently building some 26 nuclear reactors. The China National Nuclear Corporation is owned and managed by the Chinese government and is in charge of the Chinese nuclear weapons and nuclear power industries. The CNNC developed China's first atomic bombs, thermonuclear warheads, and nuclear submarines. It is estimated that China may have several hundred nuclear warheads and several dozen intercontinental ballistic missiles capable of reaching North America.

Regarding Powertech, Azarga's takeover of the Centennial project will likely be followed by an announcement that the Hong Kong company believes borehole mining and ablation are better suited for the project than in-situ leaching. In particular, look for Molyneux to claim that borehole mining and ablation are more environmentally benign than ISL, and that the technologies allow for the economical extraction of the shallow, unsaturated uranium deposits located in the southern part of the project. These shallow deposits were an ongoing problem for Powertech from a technical and engineering standpoint, as they were not amenable to typical in-situ leaching methods.

Since Powertech appears dependent on Azarga for near-term financing, Molynuex probably yields more influence over the Canadian company than would normally be expected from a 17.5% shareholder. In fact, recent statements by Dewey-Burdock project manager and Powertech employee Mark Hollenbeck raise questions about Azarga's intentions: "They (Powertech) will need a larger financier going forward...It may be a sell-out of the project." It would not be surprising to see a deal in the next few months giving Azarga control of the Dewey-Burdock project, particularly if Powertech's multi-year efforts to obtain mining permits don't soon bear fruit.

If Azarga successfully gains control of Dewey-Burdock, or Powertech itself, Molyneux can promote borehole mining and ablation for the South Dakota project as well as Powertech's Wyoming properties. After creating the perception that Powertech's projects are more environmentally friendly, he can then attempt to sell Centennial, Dewey-Burdock, and the Wyoming properties to a larger company, realizing a return for himself and his Asian investors.

Jim Woodward

Weld County, Colorado

Jim Woodward lives two miles from the proposed Centennial uranium project and has been researching and writing about Powertech Uranium Corp. on www.powertechexposed.com since June 2007.